Effective real estate data collection enables informed decision-making, strategic optimization, and competitive advantage. Prioritizing data collection is essential for profitable growth and long-term success in a dynamic market.

Contents

- Understanding data collection in real estate

- Types of data collected in real estate and their role

- Key sources of real estate data collection

- Real estate data collection methods

- Challenges in real estate data collection & management

- How real estate professionals can leverage data collection for success

- Best practices for effective data collection in real estate

- Conclusion

The real estate industry is undergoing a profound transformation, fueled by the growing availability and strategic use of property data. Real estate data collection and analysis have become critical to success in this dynamic market, empowering professionals to make informed decisions, optimize strategies, and achieve better outcomes. From property valuations and investment analysis to market research and customer relationship management, data-driven insights are reshaping how real estate businesses operate, sustain and thrive.

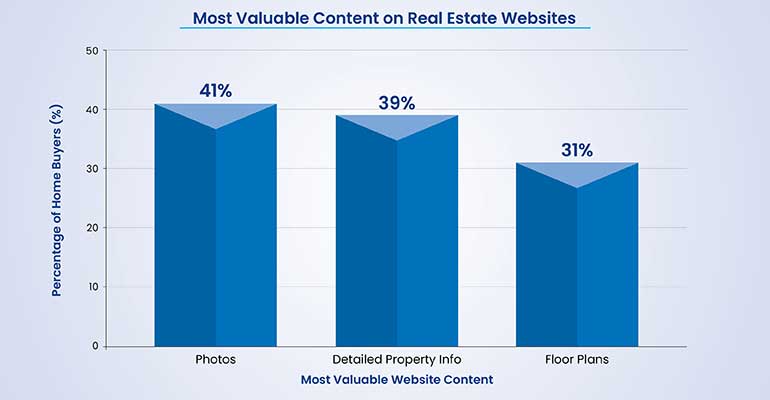

A recent survey by the National Association of Realtors found that all home buyers used the internet to search for a home. The most valuable content on websites were photos (41%), detailed information property information (39%), and floor plans (31%).

This shift towards online platforms and digital resources has made data collection more accessible and crucial than ever before. Real estate companies who embrace data-driven decision-making gain a significant competitive advantage, as they can leverage insights to identify trends, predict market shifts, and tailor their services to meet evolving customer needs.

This article talks about the role of data collection in achieving real estate success. It explores the impact of data collection on various aspects of the industry and provides insights into how to leverage data effectively for property market analysis, predictive analytics and data-driven valuation services.

Understanding data collection in real estate

Real estate data collection is the backbone of informed decision-making, enabling professionals to analyze trends, understand markets, and optimize strategies in a tech-driven industry.

What is data collection in real estate?

Data collection in real estate involves the systematic gathering of relevant information from various sources. This includes data on properties, market dynamics, customer behavior, and factors impacting the real estate landscape. The goal is to compile comprehensive and accurate data for analysis to generate valuable insights and drive informed decision-making.

Types of data used in real estate industry

- Market Trends: Data on pricing, inventory levels, sales volume, and market activity provide a comprehensive view of market dynamics. This information helps real estate professionals understand current conditions, anticipate future trends, and make informed decisions.

- Property Values: Collecting data on property characteristics, comparable sales, and market conditions enables accurate valuation of properties, which is crucial for fair transactions and investment decisions.

- Customer Insights: Understanding customer preferences, demographics, and search behavior allows real estate professionals to tailor their services and marketing efforts to specific customer segments, improving efficiency and effectiveness.

- Financial Data: Data on mortgage rates, interest rates, and other financial indicators provides valuable context for investment analysis and decision-making.

- Location and Geographic Data: Information about property location, neighborhood characteristics, proximity to amenities, and school districts plays a crucial role in assessing property value and desirability.

How has data collection evolved with technology

Technological advancements have made real estate data collection more efficient, accessible, and comprehensive. The rise of online platforms, mobile apps, and digital tools have streamlined the process of gathering and analyzing data.

- Web Scraping and APIs: Automated tools can extract data from websites and online databases, providing access to vast amounts of information quickly and efficiently.

- MLS Systems: Multiple Listing Services (MLSs) offer centralized databases of property listings, providing real estate professionals with access to comprehensive and up-to-date information.

- AI and Machine Learning: Artificial intelligence and machine learning algorithms are being used to automate data collection, improve data accuracy, and generate predictive analytics.

- Big Data and Analytics: Advanced analytics platforms can process and analyze large datasets, uncovering hidden patterns and generating valuable insights for decision-making.

Data collection is the driving force behind informed decisions and strategic actions. By understanding the nuances of data collection, real estate companies can unlock valuable insights, optimize their strategies, and achieve sustainable success in dynamic markets.

Want to transform your real estate business with property data insights?

Contact us today! »Types of data collected in real estate and their role

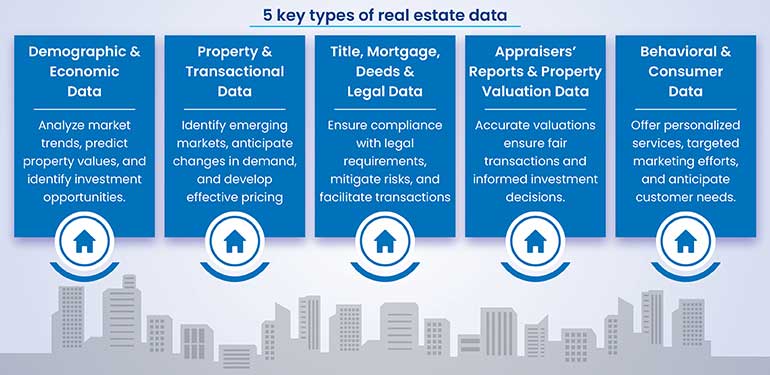

Real estate data collection encompasses a wide range of information, each playing a crucial role in understanding market dynamics, property values, and customer behavior. This data fuels informed decision-making, drives successful transactions, and empowers real estate professionals to navigate the complexities of the market effectively.

1. Demographic & economic data

Demographic and economic data provide valuable insights into the factors that influence the real estate market.

- Population Growth & Demographics: Understanding population growth, age distribution, and household composition helps predict housing demand and identify target markets.

- Economic Indicators: Factors like GDP growth, interest rates, and inflation rates influence property prices and investment decisions.

The role of demographic and economic data

Using demographic and economic data empowers real estate companies to make informed decisions. By understanding population characteristics, income levels, and economic trends, they can identify target markets, tailor products and services, optimize marketing strategies, and mitigate investment risks. This data-driven approach leads to more effective resource allocation, improved customer satisfaction, and increased profitability.

Analyzing demographic and economic data helps real estate professionals analyze market trends, predict property values, and identify investment opportunities.

2. Property & transactional data

Property and transactional data provide a comprehensive view of individual properties and their historical performance in the market.

- Sales History & Property Ownership Records: Tracking past sales data, including prices, dates, and ownership details, provides valuable context for current valuations and market analysis.

- Comparable Market Analysis (CMA): Comparing a subject property to similar recently sold properties helps determine its fair market value and establish competitive pricing.

- Rental Data & Lease Agreements: Data on rental rates, lease terms, and occupancy rates provide insights into the rental market and investment potential.

The role of property and transactional data

Using property and transactional data empowers real estate professionals to make informed decisions. By analyzing property characteristics, ownership history, and past transactions, they can accurately assess property values, identify market trends, and develop effective investment strategies. This data-driven approach leads to better investment returns, reduced risks, and increased efficiency in the real estate market.

Analyzing this data allows real estate professionals to identify emerging markets, anticipate changes in demand, and develop effective pricing and marketing strategies.

3. Title, mortgage, deeds & legal data

Legal and financial data related to property ownership and transactions are essential for ensuring secure and transparent transactions.

- Title Records & Deed Transfers: Title records and deed transfers provide a clear chain of ownership and help identify potential legal issues or encumbrances.

- Mortgage Rates & Loan Terms: Data on mortgage rates and loan terms helps buyers and investors understand financing options and make informed decisions.

- Encumbrances & Liens: Identifying any encumbrances or liens on a property is crucial for protecting buyers and investors from potential financial liabilities.

- Zoning & Land Use Regulations: Zoning and land use regulations dictate how a property can be used and developed, impacting its value and potential.

The role of title, mortgage, deeds & legal data

Using title, mortgage, deeds, and legal data brings transparency and security to real estate transactions. By accessing this information, buyers, sellers, and lenders can verify ownership, identify potential liens or encumbrances, and ensure legal compliance. This reduces risks, prevents fraud, and streamlines the closing process, leading to smoother and more secure real estate transactions.

This data ensures compliance with legal requirements, mitigates risks, and facilitates smooth transactions.

4. Appraisers’ reports & property valuation data

Appraisals and valuation data provide objective assessments of property value, crucial for both buyers and sellers.

- Market Appraisals: Professional appraisers use various methods to determine the fair market value of a property, considering factors like location, condition, and comparable sales.

- Comparable Sales Approach (Comps): This approach compares the subject property to similar recently sold properties to estimate its value.

- Cost Approach & Income Approach: These approaches consider the cost of replacing the property or its potential income generation to determine value.

The role of appraisers’ reports & property valuation data

Using appraisers’ reports and property valuation data enables accurate and objective property assessments. This data helps buyers, sellers, and lenders determine fair market value, make informed investment decisions, and secure appropriate financing. By relying on professional appraisals and robust valuation data, stakeholders can minimize risks, avoid disputes, and ensure fair transactions in the real estate market.

Accurate valuations ensure fair transactions and informed investment decisions.

5. Behavioral & consumer data

Understanding consumer behavior and preferences is crucial for effective marketing and customer service in real estate.

- Online Searches & Website Interactions: Tracking online searches, website interactions, and property preferences provides insights into buyer behavior and interests.

- AI-Powered Platforms: AI-powered real estate platforms analyze buyer behavior to personalize recommendations and improve customer experience.

- GIS (Geographic Information Systems): GIS technology enables the creation of interactive maps that visualize property locations, neighborhood characteristics, and other relevant data, enhancing market analysis and property search capabilities.

The role of behavioral & consumer data

Using behavioral and consumer data enables businesses to personalize their marketing and customer experiences. By understanding consumer preferences, habits, and purchase patterns, companies can tailor their offerings, target specific demographics, and optimize their marketing strategies. This data-driven approach leads to increased customer engagement, improved brand loyalty, and ultimately, higher conversion rates and sales.

This data empowers real estate professionals to personalize their services, target their marketing efforts, and anticipate customer needs.

The diverse types of data collected in real estate play a crucial role in driving success across various aspects of industry. By understanding the significance of each data type and leveraging it effectively, real estate professionals can make informed decisions, optimize strategies, and achieve their goals in a dynamic and competitive market.

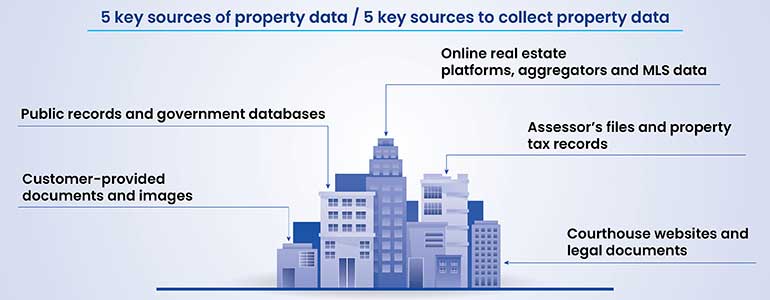

Key sources of real estate data collection

Real estate data fuels the industry, providing valuable insights for professionals and businesses alike. To gain a comprehensive understanding of the market and make informed decisions, it’s essential to tap into diverse and reliable data sources.

1. Public records & government databases

Government agencies maintain a wealth of real estate data that is often publicly accessible.

- Property Records, Land Titles, and Tax Assessments: These records provide detailed information about property ownership, legal descriptions, transaction history, and assessed values. This data is crucial for property valuation, market analysis, and due diligence.

- Zoning Laws and Planning Permissions: Zoning data provides insights into permitted land uses, building regulations, and development restrictions.

This information is essential for developers, investors, and real estate professionals involved in land use planning and development projects.

2. Online real estate platforms, aggregators and MLS data

Online platforms and real estate aggregators have become major sources of real estate data.

- Third-Party Listing Websites: Sites like Zillow, Redfin, and Trulia collect and aggregate vast amounts of data on property listings, sales trends, and market dynamics. This data allows real estate professionals to compare property values, analyze market trends, and identify investment opportunities.

- Multiple Listing Services (MLSs): MLSs provide real estate professionals with access to comprehensive and up-to-date property listings, including detailed property information, photos, and transaction history. This data is crucial for agents and brokers to match buyers with suitable properties and facilitate transactions.

3. Assessor’s files & property tax records

County assessor’s offices maintain detailed records related to property valuations and tax assessments.

- Property Valuation Reports: These reports contain information about property characteristics, recent sale prices, ownership history, and land use classifications. It is also used to determine property taxes and assess fair market value.

4. Courthouse websites & legal documents

Courthouses provide access to a wealth of legal documents and records related to real estate transactions.

- Real Estate Transactions, Foreclosures, Deeds, Liens, and Probate Filings: These records provide verified legal ownership details, mortgage statuses, and any outstanding liens or encumbrances on properties. This information is crucial for conducting due diligence, identifying investment opportunities, and assessing potential risks.

5. Customer provided documents & images

Real estate professionals often collect data directly from their clients.

- Purchase Agreements, Inspection Reports, Mortgage Documents, and Property Images: These documents and images provide valuable information about a property’s condition, transaction details, and financial aspects. AI-powered tools can be used to extract key data from these documents and analyze property images for condition assessment and automated valuation.

Real estate data collection involves tapping into a variety of data sources, both public and private, to gather comprehensive and accurate information. By leveraging these diverse sources and employing appropriate data collection methods, real estate professionals gain valuable insights to make informed decisions, and grow profitably.

Real estate data collection methods

Effective data collection is the foundation for informed decision-making and success in the real estate industry. To gain a comprehensive understanding of the market and individual properties, real estate professionals employ various data collection methods, each with its own strengths and challenges.

1. Web scraping for real estate data

Web scraping involves extracting data from online sources such as property portals, real estate websites, and government databases. This method allows for the collection of large volumes of data quickly and efficiently.

- Extracting Property Listings, Prices, and Market Trends: Web scraping tools can automatically gather data on property listings, including details like price, location, size, and features. This data can be used to analyze market trends, identify investment opportunities, and track competitor activity.

- Legal and Ethical Considerations: It’s crucial to adhere to legal and ethical guidelines when scraping data from websites. Respecting website terms of service, robots.txt directives, and copyright laws is essential to avoid legal issues and maintain ethical data collection practices.

2. Data extraction from public & private records

Public and private records offer a wealth of information about properties, ownership, and transactions.

- Mining Government Databases, Tax Records, and Land Registries: Government agencies maintain databases with valuable real estate data, including property tax records, land ownership details, and historical sales data. Accessing and extracting it provides valuable insights for property valuation and market analysis.

- OCR (Optical Character Recognition): OCR technology can convert scanned documents or images of handwritten records into digital text, making it easier to extract and analyze data from historical records or physical documents.

3. APIs & data feeds for automated data collection

APIs (Application Programming Interfaces) provide a standardized way to access real-time data from various sources.

- Integrating REST/SPEED APIs and Google Places API: Real estate data providers often offer APIs that allow for seamless integration with other applications and systems. These APIs can provide access to a wide range of data, including property listings, market trends, and location-based information.

- Data Sharing and Refreshment: Data collected through APIs can be shared with clients through various methods, such as secure FTPs, cloud storage, or direct API access. Data feeds can be refreshed regularly (e.g., weekly or monthly) to ensure that clients have access to the latest information.

- Real-Time Data Feeds vs. Static Data Scraping: Real-time data feeds provide up-to-the-minute information, which is crucial for time-sensitive applications like market analysis and investment decisions. Static data scraping, while valuable for historical analysis, may not be suitable for applications that require real-time insights.

4. Image keying & AI-based property analysis

Advancements in image recognition and artificial intelligence are transforming real estate data collection.

- AI-Powered Image Recognition: AI algorithms can analyze property images to assess property conditions, identify features, and even gauge neighborhood appeal. This technology can automate tasks like property inspections and generate property value estimates based on visual data.

- Image-Based Property Inspections: Machine learning models can be trained to identify potential issues in property images, such as structural damage, maintenance needs, or safety hazards. This can streamline property inspections and provide valuable insights for buyers, sellers, and property managers.

Real estate data collection involves a combination of traditional and cutting-edge methods, each playing a crucial role in gathering comprehensive and accurate information. By understanding the strengths and challenges of each method, real estate professionals can choose the most appropriate approaches for their specific needs and leverage the power of data to drive success in the industry.

Challenges in real estate data collection & management

While property data is a valuable asset in the real estate industry, its collection and management comes with its own share of challenges. Addressing these ensures data accuracy, protecting privacy, and maximizing data value for informed decision-making.

Data accuracy & quality issues

- Incomplete, Outdated, or Incorrect Data: Real estate data often suffers from inaccuracies, missing information, or outdated records. This can lead to flawed valuations, inaccurate market analysis, and misinformed decisions.

- Solutions: AI-driven data validation tools automatically identify and correct errors, while blockchain technology creates tamper-proof records, enhancing data integrity and trust.

Privacy & data security concerns

- Legal Regulations and Ethical Issues: Real estate data often includes sensitive personal information, raising privacy concerns. Regulations like GDPR and CCPA impose strict rules on data collection and handling. Ethical considerations also play a role in ensuring responsible data usage.

- Securing Customer Data and Transaction Records: Protecting confidential information, such as financial records and personal details, is paramount. Robust security measures, including encryption and access controls, are essential to prevent data breaches and maintain client trust.

Integration of multiple data sources

- Challenges of Merging Data: Real estate data comes from diverse sources, including public records, IoT devices, online platforms, and customer-provided documents. Integrating this data into a unified system can be challenging due to varying formats, inconsistencies, and the need for data transformation.

- Solution: Cloud-based data management systems offer a centralized platform for storing, managing, and analyzing data from multiple sources. These systems can automate data integration, standardize formats, and provide tools for data cleansing and validation.

Real estate data collection and management present challenges related to data accuracy, privacy, security, and integration. By addressing these challenges through technological solutions, robust data governance practices, and ethical considerations, real estate professionals can harness the full potential of data to drive success in the industry.

Share your real estate data collection challenges.

Explore our solutions! »How real estate professionals can leverage data collection for success

Data collection has become an indispensable tool for real estate professionals seeking to thrive in a competitive market. By harnessing the power of data, agents, brokers, investors, and property managers can gain valuable insights that inform their strategies, optimize their operations, and drive better outcomes.

Optimizing property valuation & investment decisions

- Comparative Market Analysis (CMA): Analyzing historical sales data of comparable properties allows for accurate valuation of properties, ensuring fair pricing and informed negotiations. This data helps real estate professionals determine a property’s fair market value, supporting both buyers and sellers in making informed decisions.

- Predictive Analytics & Machine Learning: Advanced analytics and machine learning models can forecast property value trends, identify investment opportunities, and assess potential risks. This empowers investors to make data-driven decisions and optimize their portfolios.

- Data-Driven Valuation Services: Real estate professionals can leverage data-driven valuation services to provide accurate and reliable property valuations to their clients. This enhances their credibility, builds trust, and facilitates smoother transactions.

Enhancing real estate marketing & lead generation

- Big Data in Personalized Marketing: Analyzing large datasets on customer preferences and behavior enables targeted marketing campaigns. This allows real estate professionals to reach the right audience with personalized messages, increasing engagement and lead generation.

- CRM & Email Database Management: Customer Relationship Management (CRM) systems and email databases help manage leads, track interactions, and nurture client relationships. This data-driven approach fosters stronger connections and improves client retention.

- Real Estate Data Scraping: Scraping data from competitor websites and online platforms provides valuable market intelligence. This allows real estate professionals to analyze competitor strategies, identify market trends, and fine tune their strategies.

Improving operational efficiency with data management

- Automating Property Data Collection: Automating data collection through tools like web scraping and APIs streamlines workflows and reduces manual effort. This increases productivity and allows real estate professionals to focus on core business activities.

- Data Verification & Cleansing: Implementing data verification and cleansing processes ensures data accuracy and consistency. This eliminates errors, reduces duplication, and improves the reliability of data for analysis and decision-making.

- Outsourcing Real Estate Data Services: Outsourcing data collection and management tasks proves to be a smart move. This allows real estate businesses to access expertise and technology without the overhead of building in-house capabilities.

Property data collection empowers real estate professionals to make informed decisions, optimize strategies, and achieve greater success. By leveraging data for property valuation, marketing, and operational efficiency, real estate businesses can thrive in a competitive market and deliver exceptional value to their clients.

Best practices for effective data collection in real estate

Effective data collection is the bedrock of informed decision-making and success in the real estate industry. To ensure data accuracy, reliability, and usability, it’s essential to adopt best practices that streamline processes, maintain data quality, and leverage technology effectively.

1. Standardized data collection processes

- Establishing Consistent Data Formats: Standardizing data formats for property records, market trends, and consumer insights ensures consistency and facilitates data integration and analysis. This involves using uniform terminology, data fields, and measurement units across all sources.

- Implementing Industry-Standard Protocols: Adhering to industry standards and best practices for data collection ensures data quality and compatibility. This includes following guidelines for data entry, validation, and storage, as well as using standardized data exchange formats.

2. Implement data audit and validation techniques

- Regularly Auditing Real Estate Data Sources: Regular audits help identify inaccuracies, inconsistencies, and gaps in data. This involves comparing data from different sources, verifying information against authoritative sources, and checking data anomalies.

- Using AI-Powered Validation Tools: AI-powered tools automate data validation processes of verifying property transaction histories, identifying potential fraud, and flagging inconsistencies. This improves data accuracy and reduces manual effort.

3. Leverage technology for automated data collection

- Integrating AI, Web Scraping, and API-Based Automation: Technology plays a crucial role in streamlining data collection. AI can automate data extraction and analysis, web scraping can gather data from online sources, and APIs can provide access to real-time data feeds.

- Benefits of Real-Time Data Extraction: Real-time data extraction enables dynamic pricing, facilitates timely investment decisions, and provides up-to-the-minute market insights. This is crucial for staying ahead of the competition and responding quickly to market changes.

4. Regularly audit and cleanse data

- Removing Duplicate, Outdated, or Irrelevant Data: Data cleansing is essential for maintaining data quality and relevance. This involves removing duplicate records, updating outdated information, and purging irrelevant data from real estate databases.

- Using Automated Data Cleansing Algorithms: Automated tools can streamline data cleansing processes by identifying and correcting errors, standardizing formats, and removing inconsistencies. This improves data reliability and reduces manual effort.

Adopting data collection best practices is crucial for real estate success. By standardizing processes, implementing data validation techniques, leveraging technology for automation, and regularly auditing and cleansing data, real estate professionals can ensure data accuracy, reliability, and usability, empowering them to make informed decisions and achieve their business objectives.

Conclusion

Data collection and analysis have become indispensable for success in the dynamic real estate industry. By harnessing the power of data, real estate professionals gain valuable insights that drive informed decision-making, optimize strategies, and enhance overall performance. From accurate property valuations and targeted marketing campaigns to risk mitigation and streamlined operations, data empowers real estate businesses to thrive in a competitive market.

Embracing data-driven approaches is no longer optional; it is essential for achieving sustainable growth, maximizing profitability, and navigating the complexities of the real estate landscape. As industry continues to evolve, prioritizing data collection and analysis will be crucial for staying ahead of the curve and achieving lasting success.

Struggling to collect real estate data to analyze trends and identify opportunities?

Reach out us today! »

Snehal Joshi heads the business process management vertical at HabileData, the company offering quality data processing services to companies worldwide. He has successfully built, deployed and managed more than 40 data processing management, research and analysis and image intelligence solutions in the last 20 years. Snehal leverages innovation, smart tooling and digitalization across functions and domains to empower organizations to unlock the potential of their business data.