Inefficient invoice processes erode your credibility with suppliers, create production bottlenecks and threaten cash flow. Digitize and redefine your accounts payables to get a clearer picture of your financial health and make payables agile and efficient.

How many invoices from your regular suppliers are late reaching your accounts payable team? Inefficient invoice processing services can affect the bottom line of manufacturers of any scale. Maintaining bulky records and spreadsheets, manual checks and lengthy approval mechanism add up to overall costs, and loss of time and efforts.

According to a report by IOFM, among companies that manually process fewer than 20,000 payments per year, only 24% can pay Purchase Order (PO) based invoices on time.

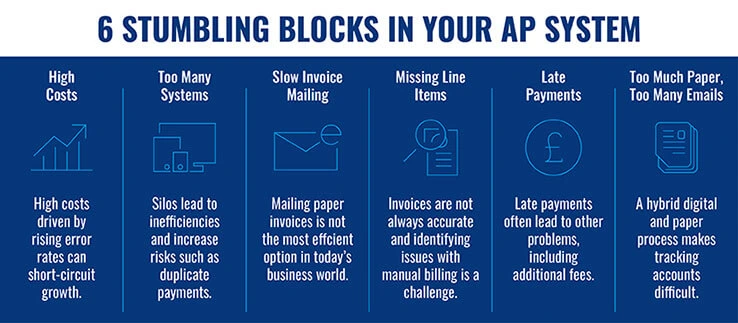

Here we discuss some of the most common issues hampering the smooth processing, validation and payment of invoices, and relevant invoice processing solutions.

Invoice processing challenges that disrupt manufacturing efficiencies

Manually entering invoice data, verifying purchase orders and an endless chain of manual filing breeds inefficiencies in invoice processing services. Collection, validation, routing, approval and payouts of paper-based or email-based invoices are time-consuming too. And here’s how it affects manufacturing functions.

1. Irregularity in invoice payment impacts supplies and production

Every manufacturing unit needs to make critical investments in procuring raw materials, consumables, machinery, and equipment. They manage a vast supplier-vendor network across geographies. If invoices aren’t paid within timelines, it can frustrate suppliers, jeopardize inventory levels and create production bottlenecks.

2. Invoicing ambiguities invite penalties

It’s important for both the payer and the payee to have a clear idea about amounts, payment cycles, accepted payment methods, descriptions, rates, quality standards, quantities, etc. Any discrepancies in these terms create risks of late payments or deliveries. Legacy systems, or any confusion felt by accounts teams, can delay payments.

Resolving such confusion can be cumbersome and time-consuming, and often burns a hole in the cash flow.

Stop relying on time-consuming and error-prone manual invoice processes.

Optimize your invoice processing lifecycle with automation to reduce human errors, turnaround time and costs.

Get started today »3. Delay in invoice processing affects credibility

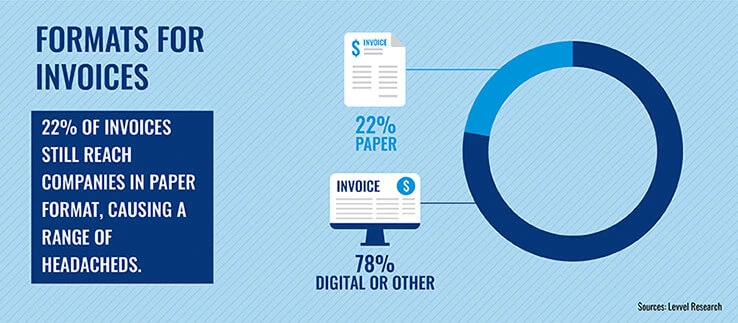

Most mid to large-sized manufacturers have a wide range of suppliers who submit various types of invoices in different formats and to different people. Processing thousands of invoices monthly is arduous and invites errors leading to late or incorrect payments.

Affected vendors shorten payment terms or lower supply, service or quality standards. This potentially hampers your production line and erodes goodwill and brand reputation.

A leading logistics company suffered heavy dents to its brand reputation due to erroneous invoice records and subsequent late payments. HabileData stepped in to create a centralized repository and a structured workflow to ensure flawless payments.

4. Multiple data points across invoices increase data capture complexities

Companies process hundreds of thousands of invoices each year. Many of these are complex and contain a huge number and range of data points. Missing out on any critical data hampers communication, routing, and invoice approval.

Using manual methods to process massive amounts of invoice information and supplier data is a grueling task. It gets worse if there’s missing information or blurry invoice images.

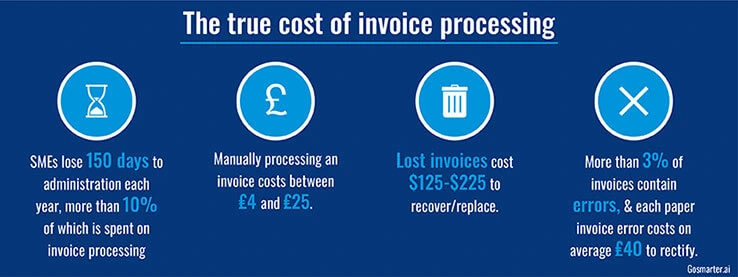

5. Missing/duplicate invoices impact cash flow

Managing multiple invoices from vendors can create massive confusion. Most suppliers don’t send invoices regularly, thus upsetting the planning and scheduling of payouts. Also, there are chances of receiving and approving duplicate invoices from the same supplier that can cause excess payments, and subsequent recovery hassles.

In the absence of a streamlined payment process, the friction between Accounts Payable managers and suppliers results in unpaid invoices. Eventually, it obstructs optimal cash flow.

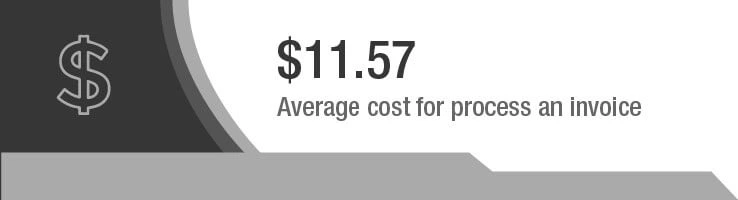

6. High cost of lengthy and manual invoice processing

Cost in terms of time, effort and money poses a major challenge in invoice processing. According to a report by IOFM, the average cost for manufacturers handling up to 100,000 invoices per year is about $6.10 per invoice when processed manually. For manufacturers that process 20,000 or fewer invoices, the cost is a staggering $15.97 per invoice.

The cost spent per invoice and purchase order can vary from one manufacturer to another depending on the factors that are included in this calculation. Following a manual approach will have higher processing costs when compared to other manufacturers using an automated process.

A global supply chain solutions company, receives thousands of bank transfers daily from its multiple partners. It was a major challenge for them to handle payment processing manually.

To get rid of duplicate entries, cut down on processing time and accelerate payments, they automated certain processes through custom tools to collect information, identify duplicate entries, and automate approvals. Automation helped to increase processing productivity by 70% and reduce turnaround time by a factor of 10.

7. No visibility across manufacturing spends

Disorganized invoicing processes and outdated systems create information silos and provide poor to no visibility. The absence of a unified information management process deprives manufacturers of critical insights on spending patterns that can be used for budgeting, inventory and supply chain planning.

8. Non-compliance of contractual agreements affects security

Maintaining contractual, legal and policy compliance is crucial when invoices are exchanged between two parties. Elements like authenticity of origin, integrity of the content, storage and legibility have to be in accordance with local legislation or rules. Not harmonizing with the legal compliance requirements can lead to a rise in the ratio of disputed invoices to total invoices and price paid to actual price quoted.

Benefits of digitalizing invoice processing

- Credibility with material and machine suppliers

- Agile and accelerated processes

- Error-free invoicing; avoid duplicate supplier payments; track missing invoices

- Fewer vendor claims

- Streamline raw material flow, avoid production bottlenecks

- Optimize cost of invoice processing

- Better cash flow management

- Greater transparency

- Better spend analysis across the payables value chain; factor in historical transactions

- Invoice processing from anywhere, anytime – across devices

Simplify and accelerate your invoice management.

Get in touch with our experts to eliminate paper-based processes and automate accounts payables function.

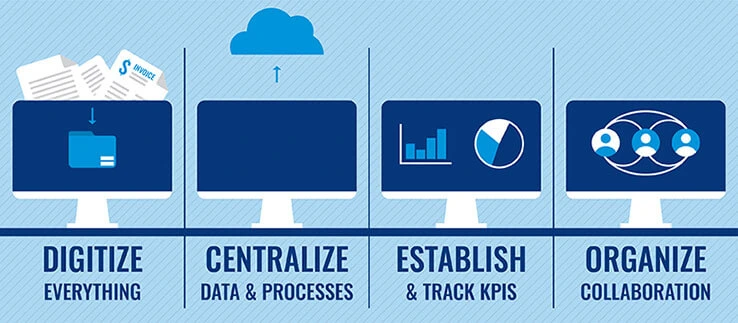

Get started today »Digitalize and redefine accounts payable processes for higher efficiencies

Digitalization has simplified information storage, processing, indexing and retrieval from invoices doing away with endless hours spent on managing paper-based documents.

A smart invoicing system addresses data silos across the payables cycle offering end-to-end visibility into payment schedules, deviations, and pricing patterns.

It was a day-to-day struggle for a USA-based Energy and Utility Company to manage the influx of thousands of invoices manually. Missed payments, wrong entries, and readability issues invited dissatisfaction of vendors and customers. Adopting a structured invoice processing solution and focusing on accuracy and speed helped to resolve quality issues. Read how HabileData experts turned the tables around.

Let’s look at some technology options that add pace and accuracy while eliminating the challenges of your invoicing processes.

Bots, macros and business-rules driven algorithms

Manufacturers are increasingly partnering with invoice processing companies to use customized bots for data extraction from unstructured invoices available in multiple formats. Intelligent business rules and algorithms help streamline and pace up processes. Some applications of bots and algorithms for invoice processing solutions are:

- Data capture, extraction and retrieval from multiple invoices

- Data standardization and collation in structured databases

- Routing of invoices to appropriate channels for approvals

- Prioritize invoices for payments

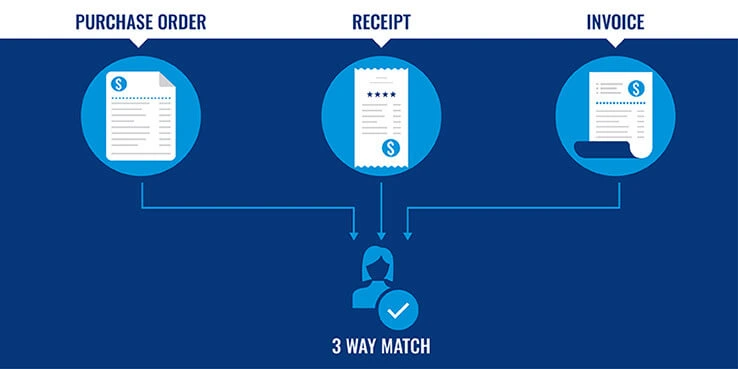

- Reconciliation of invoices against purchase orders

- Invoice classification by date, vendor name, amounts, etc.

- Detect, tap and index various electronic channels like email boxes, web portals, etc. for incoming invoices at regular intervals

- Compress and display digital invoices in popular formats like JPEG, PDFs, etc.

- Archive data for future audit and compliance requirements in a single database

Agile and automated workflows

Defining and automating workflows streamlines invoice processing across stages including invoice data entry, validation, prioritization, categorization, approval and payments. With smart and agile workflows, the accounts payable team can:

- Reduce duplicate invoices and payments

- Cut down the cost of manual invoice processing

- Classify and prioritize invoices based on criticality of material, vendor type, amount, payment due date, etc.

- Track various checkpoints, such as invoice receipt, expense approvals, records, ledger entry, queries, scheduling etc. for easy payment processing and retrieval

- Establish better and transparent collaboration between vendors and sales departments

- Maintain a balance of incoming cash flow

- Leverage data-driven insights on liquidity planning and forecasting

Automated invoice processing workflow

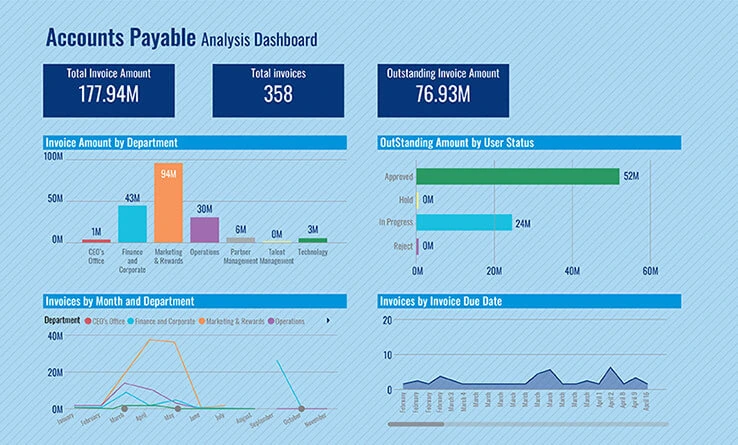

Dashboards and reports

Granular and drilled down reports through interactive dashboards help the accounts payables team to get visibility into spends across various functions. By configuring dashboards to meet specific needs, manufacturers can easily:

- Track key KPIs and metrics like paid invoices, pending time to payment due date, invoice processing time, invoice volume, etc.

- Leverage critical and authentic information on working capital, utility costs and more.

- Get timely alerts and notifications to reduce chances of missed, forgotten, late or false payments, etc.

Precisely what you should expect from a digital invoice system

The evidence is loud and clear: Manual invoice processes are time-consuming, inefficient and largely ridden with errors with no visibility to decision-makers about the business. As a result, the sole function that should be a value-driver for any manufacturer turns into a revenue guzzler.

With a digitized and data driven invoice management system, it is possible to nullify the impact of legacy-system issues. Apart from being easy to manage and efficient, digitally-enabled invoice processing services help your teams with data to make critical finance decisions.

Automated data extraction, capture, analysis, and retrieval helps accounts teams and suppliers to build a culture of mutual trust with regular and correct payments. Discover how easy it is to digitally transform your accounts payables function and create a strong financial backbone for your company.

Transform the way your accounts payable team works.

Bring speed, efficiency and visibility to your invoice processing with our digitalized workflows.

Get started today »

Snehal Joshi heads the business process management vertical at HabileData, the company offering quality data processing services to companies worldwide. He has successfully built, deployed and managed more than 40 data processing management, research and analysis and image intelligence solutions in the last 20 years. Snehal leverages innovation, smart tooling and digitalization across functions and domains to empower organizations to unlock the potential of their business data.